Bookkeeper vs. Financial Partner: Why Your Business Needs the Real Thing

- Adreanna Smith

- Dec 25, 2025

- 5 min read

Updated: 19 hours ago

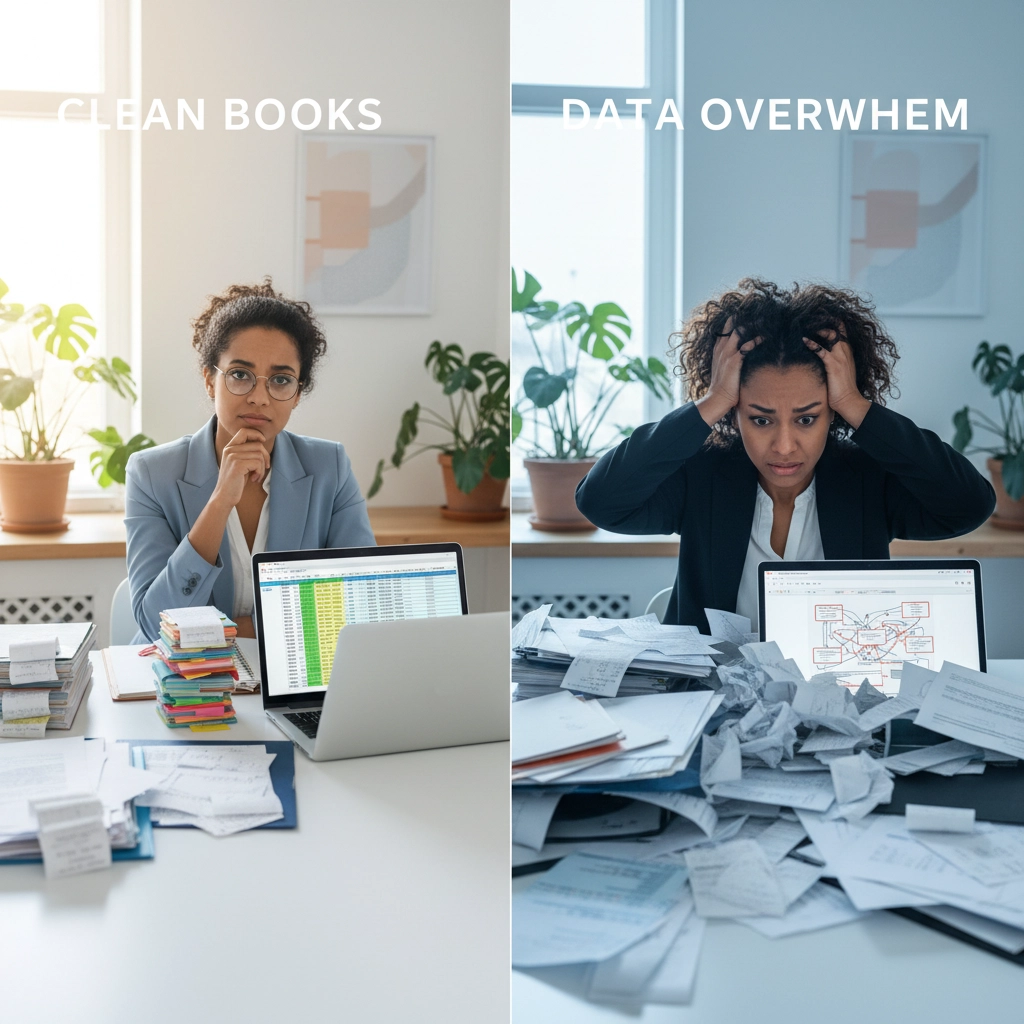

Your books are clean. Your P&L looks professional. Your transactions are categorized perfectly. So why do you still wake up at 3AM wondering if you can afford that new hire? Why does every business decision feel like a guess? This is often the moment business owners realize the difference between a financial partner vs bookkeeper really matters.

Here's the thing: having a bookkeeper isn't the same as having a financial partner. And if your chest still feels tight when you think about money decisions, despite having "good books," you're probably working with the former when you desperately need the latter.

Don't get me wrong, bookkeepers are essential. They keep your financial house in order. But stopping there is like getting a beautifully detailed blueprint of your house and never actually building it. You've got the foundation, but you're still sleeping outside.

What a Bookkeeper Actually Does (And Doesn't Do)

A bookkeeper is your financial historian. They're meticulous, detail-oriented, and absolutely critical for keeping your records straight. They handle the essential but backward-looking tasks:

Record every transaction accurately

Reconcile your bank accounts

Send invoices and track payments

Pay bills on time

Generate monthly P&L statements

Categorize expenses properly

And they do it well. Your books will be organized, your numbers will add up, and your accountant won't give you that look come tax season.

But here's what they don't do: They don't tell you what those numbers mean for your business.

When your bookkeeper hands you a P&L showing you made $15,000 last month, they've done their job. When you stare at that number wondering whether it's good, bad, or catastrophic... well, that's where their job ends and your sleepless nights begin.

What a Financial Partner Brings to the Table

A financial partner takes those same numbers and turns them into a roadmap. They're not just recording your financial past, they're helping you navigate your financial future.

They ask the questions that keep you up at night:

Why did our margins drop 3% this quarter?

Should we hire that new team member next month?

How much cash should we keep in reserves?

Are we pricing our services correctly?

What happens if that big client doesn't renew?

More importantly, they help you find the answers.

Financial Partner vs Bookkeeper: The Real-World Difference

Let me paint you a picture. Two business owners, same industry, similar revenue:

Business Owner A has a great bookkeeper. Books are pristine. Every month, they get a beautiful P&L statement. But when their biggest client threatens to leave, they have no idea how to calculate the impact or what to do about it. They lose sleep, make gut decisions, and hope for the best.

Business Owner B has a financial partner. Same clean books, but when that client situation hits, they already know that client represents 23% of revenue, they have a cash flow model that shows exactly how long they can operate without them, and they've identified three strategies to either retain the client or replace that revenue. They sleep better because they have a plan.

Both have "good books." Only one has clarity and control.

Beyond the Numbers: Strategic Thinking

Here's where financial partnership gets really valuable, it's not just about past transactions or even current cash flow. It's about strategic thinking.

Your financial partner should be asking:

What does your cash flow pattern tell us about seasonal planning?

Are your profit margins sustainable as you grow?

Which revenue streams are actually profitable when you factor in all costs?

How should you structure pricing for that new service?

What financial metrics should you be tracking monthly?

They turn accounting from a rearview mirror into a GPS system.

When we work with clients at Smith's Accounting Company, we're not just making sure their books are accurate (though we absolutely do that). We're sitting down monthly to talk about what those numbers mean and where they want their business to go.

The Financial Partner vs Bookkeeper Mindset

The word "partner" isn't just marketing fluff. A true financial partner operates with a fundamentally different mindset than a service provider.

A bookkeeper thinks: "How do I accurately record this transaction?" A financial partner thinks: "What does this pattern of transactions tell us about the health and direction of this business?"

A bookkeeper asks: "Which category should this expense go in?" A financial partner asks: "Is this expense helping or hurting profitability, and should we be spending money differently?"

A bookkeeper reports: "Here are your numbers for last month." A financial partner explains: "Here's what your numbers mean, here's what we should watch for, and here's what I recommend for next month."

When You Need to Make the Upgrade

You know you've outgrown basic bookkeeping when:

Your business decisions feel like educated guesses

You can't answer "Can we afford this?" without stress

You're profitable on paper but cash flow feels unpredictable

You're planning to hire, expand, or make significant investments

You find yourself avoiding financial conversations because you're not sure what the numbers really mean

You want to understand not just what happened financially, but why it happened and what to do about it

Growth amplifies the need for strategic financial guidance. What worked when you were a solopreneur won't work when you're managing a team, multiple revenue streams, and complex decisions.

How We Operate as Your Financial Partner

At Smith's Accounting Company, we start with the foundation, yes, we make sure your books are accurate and complete. But then we go further.

We become your financial co-pilot. That means:

Monthly financial reviews where we explain what happened and why

Cash flow forecasting so you can plan ahead with confidence

Profitability analysis by service line, client, or project

Strategic conversations about pricing, hiring, and growth

Custom reporting that shows the metrics that matter to your business

Proactive recommendations when we spot opportunities or red flags

We're not just maintaining your financial records: we're helping you build a sustainable, profitable business that gives you clarity and control.

The ROI of True Partnership

Good financial partnership pays for itself. And while the ROI shows up in profitability, the real win in the financial partner vs bookkeeper equation is clarity. When you have someone helping you optimize pricing, manage cash flow intelligently, and make strategic decisions based on data rather than gut feeling, the improved profitability often covers the cost several times over.

But honestly? The real return isn't just financial: it's peace of mind.

It's fewer 3AM anxiety spirals about money decisions. It's confidence when opportunities arise. It's knowing that your business can weather unexpected challenges because you have a financial strategy, not just financial records.

You Deserve More Than Just Clean Books

Clean books are the starting point, not the finish line. You deserve financial clarity that actually helps you run your business. You deserve to understand what your numbers mean and feel confident about the decisions you're making.

You deserve a financial partner who gets it: someone who understands that behind every P&L statement is a real person trying to build something meaningful and sustainable.

If you're tired of staring at financial reports and feeling lost, if you're done making major decisions based on hope rather than data, it might be time to upgrade from bookkeeping to financial partnership.

Because your business: and your peace of mind: deserve the real thing.

💡 Want more no-fluff financial clarity in your inbox? Join the weekly email list: where we break down real-world money strategy for business owners who are done guessing. Click here to join the list. Let's build the financial foundation your business actually needs.

Comments